In the ever-evolving landscape of technology, few sectors pulse with as much intensity as data centers—the beating hearts of our digital world. On February 18, 2025, Arista Networks, Inc., a titan in client-to-cloud networking, released its fourth quarter and year-end financial results for 2024, unveiling a story of staggering growth, relentless innovation, and a bold vision for the future. With a record-breaking revenue of $7 billion—a 19.5% leap from 2023—and a slew of groundbreaking product announcements, Arista has not only solidified its dominance in data center switching but also positioned itself as a linchpin in the artificial intelligence (AI) revolution. For industry insiders, tech enthusiasts, and forward-thinking enterprises alike, this report is more than a balance sheet; it’s a roadmap to the next frontier of networking.

What does Arista’s ascent mean for the data center ecosystem? How is the convergence of AI and networking reshaping the way we process, store, and transmit data? And what lessons can businesses draw from a company that has turned economic uncertainty into a springboard for growth? This deep dive explores these questions, unpacking Arista’s 2024 performance and its implications for the tech world at large.

A Financial Powerhouse in a Turbulent World

Revenue Surge and Profitability: The Numbers Speak

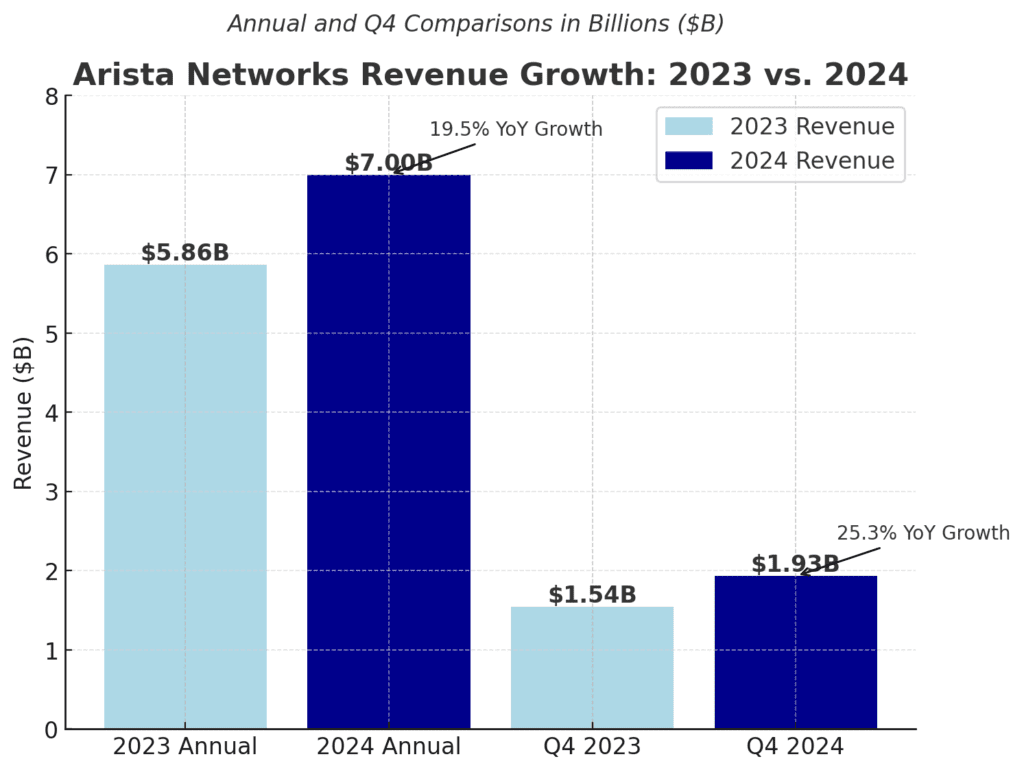

Arista’s 2024 financials paint a picture of a company firing on all cylinders. The Santa Clara-based firm reported annual revenue of $7 billion, a 19.5% increase from the $5.86 billion recorded in 2023. The fourth quarter alone brought in $1.93 billion, up 25.3% from the same period a year earlier and 6.6% from the prior quarter. These figures are not mere incremental gains; they signal a robust demand for Arista’s solutions amid a global economy still grappling with supply chain disruptions and geopolitical tensions.

Profitability, too, reached new heights. GAAP net income for the year soared to $2.852 billion, or $2.23 per diluted share, compared to $2.087 billion, or $1.65 per share, in 2023. On a non-GAAP basis, net income hit $2.91 billion, or $2.27 per share, reflecting a disciplined approach to cost management and operational efficiency. The company’s operating cash flow surged by an astonishing 95% year-over-year in Q4, a testament to its ability to convert revenue into tangible financial strength.

“We delivered exceptional financial performance in Q4, exceeding our guidance on all key metrics,” said Chantelle Breithaupt, Arista’s Chief Financial Officer, in the company’s press release. “These results allow us to continue investing in strategic initiatives such as AI and campus markets while navigating economic uncertainties.” This balance of growth and resilience is rare, positioning Arista as a beacon for others in the tech sector.

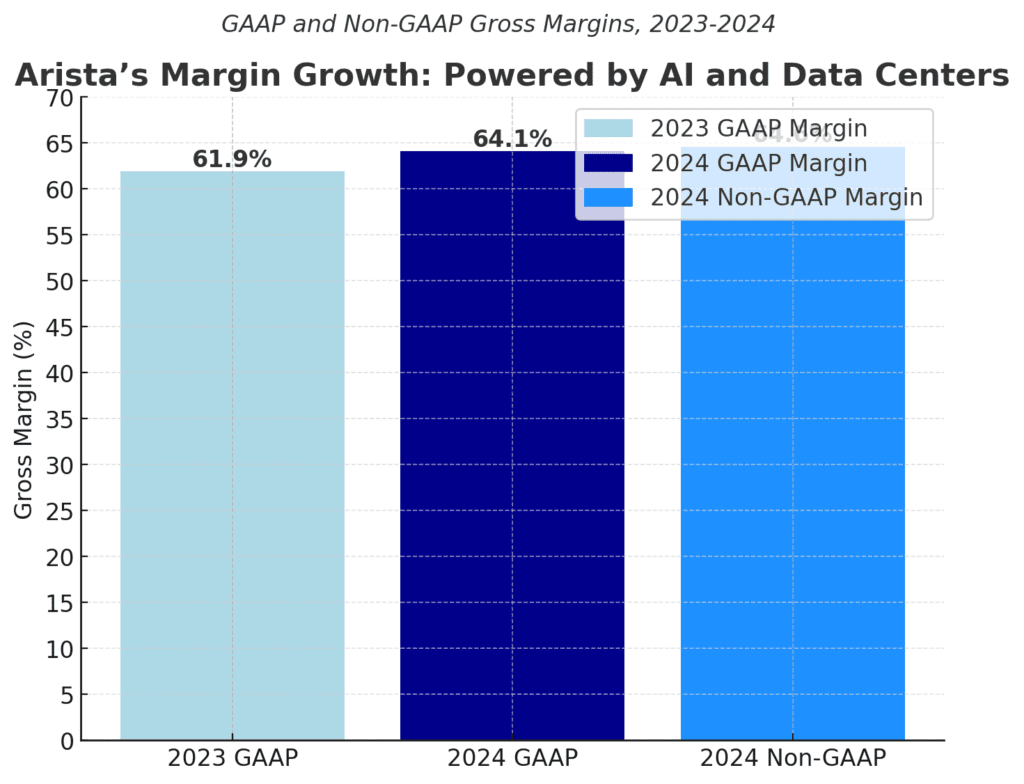

Beyond the Balance Sheet: A Strategic Vision

Numbers alone don’t tell the full story. Arista’s financial success is underpinned by a strategic focus on high-growth areas—AI, data centers, and campus networking—that are redefining the industry. The company’s ability to achieve a 64.1% GAAP gross margin (up from 61.9% in 2023) and a 64.6% non-GAAP gross margin reflects not just operational excellence but also a product portfolio that commands premium pricing. This is no accident; it’s the result of a deliberate push into markets where demand is surging and competition is fierce.

The AI Revolution Meets Networking Innovation

Etherlink AI Platforms: Powering the Next Generation

At the heart of Arista’s 2024 narrative is its pivot to AI-driven networking, a move that aligns with the explosive growth of artificial intelligence across industries. The company unveiled its Etherlink AI platforms, a suite of networking solutions designed to support AI clusters ranging from thousands to hundreds of thousands of XPUs (accelerated processing units). Unlike traditional multi-tier network architectures, Etherlink employs efficient one- and two-tier topologies, delivering superior application performance and lower latency—critical factors for AI workloads that demand real-time processing.

This innovation caught the eye of Meta, one of the world’s largest tech conglomerates. In Q4, Meta deployed Arista’s 7700R4 Distributed Etherlink Switch (DES) in its latest Ethernet-based AI cluster, a partnership that underscores Arista’s credibility in the AI space. “Meta and Arista Build AI at Scale,” the company announced, signaling a collaboration that could set the standard for AI infrastructure in the years ahead.

NVIDIA Partnership: Bridging Compute and Network Domains

Arista’s collaboration with NVIDIA further amplifies its AI ambitions. The Arista EOS AI Agent, showcased in 2024, integrates compute and network domains into a single, manageable entity. By aligning these traditionally siloed systems, Arista reduces job completion times—a boon for enterprises running complex AI models. NVIDIA, a leader in GPU technology, brings its expertise to the table, creating a synergy that could redefine how data centers handle AI-driven workloads.

For data center operators, this convergence is a game-changer. As AI applications—from generative models to autonomous systems—proliferate, the need for seamless integration between compute power and network bandwidth has never been greater. Arista’s solutions position it as a key enabler in this shift, bridging the gap between raw processing power and the infrastructure that delivers it.

Beyond Data Centers: Expanding the Horizon

Wi-Fi 7 and Campus Networks: A Broader Footprint

While data centers remain Arista’s stronghold—evidenced by its number-one market share in data center switching—the company is not content to rest on its laurels. In 2024, it launched the C-460 Wi-Fi 7 access points, designed to meet the bandwidth demands of emerging technologies like augmented reality (AR), virtual reality (VR), and the Internet of Things (IoT). These access points cater to high-density environments, such as universities and corporate campuses, where streaming multimedia and video applications are pushing traditional networks to their limits.

Arista also introduced modern stacking capabilities for campus networks with its Switch Aggregation Group (SWAG) feature in Arista EOS. This innovation allows multiple switches to be managed as a single entity via a unified IP address, simplifying administration and boosting scalability. Paired with CloudVision Leaf Spine Stack (LSS) Management, it offers a holistic approach to campus networking, extending Arista’s reach beyond the data center core.

Zero Trust Security: Safeguarding the Future

Security, too, took center stage in 2024. Arista updated its Multi-Domain Segmentation Service (MSS), enhancing its zero trust networking offerings. This solution restricts lateral movement within campus and data center networks without requiring endpoint agents—a lightweight yet robust approach to cybersecurity. In an era where breaches can cripple organizations, Arista’s focus on zero trust aligns with the industry’s growing emphasis on proactive defense.

Alabama Fiber Network: Bridging the Digital Divide

Arista’s influence extends beyond enterprise settings into the public sphere. The Alabama Fiber Network (AFN) selected Arista as its routing and switching provider for a statewide middle-mile initiative aimed at delivering affordable, high-capacity internet to underserved rural areas. This project highlights the company’s versatility, applying its expertise to address societal challenges like the digital divide—a reminder that technology’s impact is measured not just in profits but in lives transformed.

Milestones and Momentum: A 20-Year Legacy

A Year of Celebration and Achievement

2024 marked a dual milestone for Arista: its 20th anniversary as a company and the 10th anniversary of its initial public offering. Over two decades, Arista has grown from a niche player to a global leader, boasting over 10,000 customers and 100 million ports deployed worldwide. Its ascent to the top spot in data center switching—a fiercely competitive market—is a testament to its relentless pursuit of excellence.

The year also saw a four-for-one stock split, effective December 3, 2024, making Arista’s shares more accessible to investors. Trading on a split-adjusted basis began the following day, a move that reflects confidence in its long-term growth trajectory. For shareholders, it’s a tangible reward; for analysts, it’s a signal that Arista expects its upward momentum to continue.

Looking Ahead: Q1 2025 and Beyond

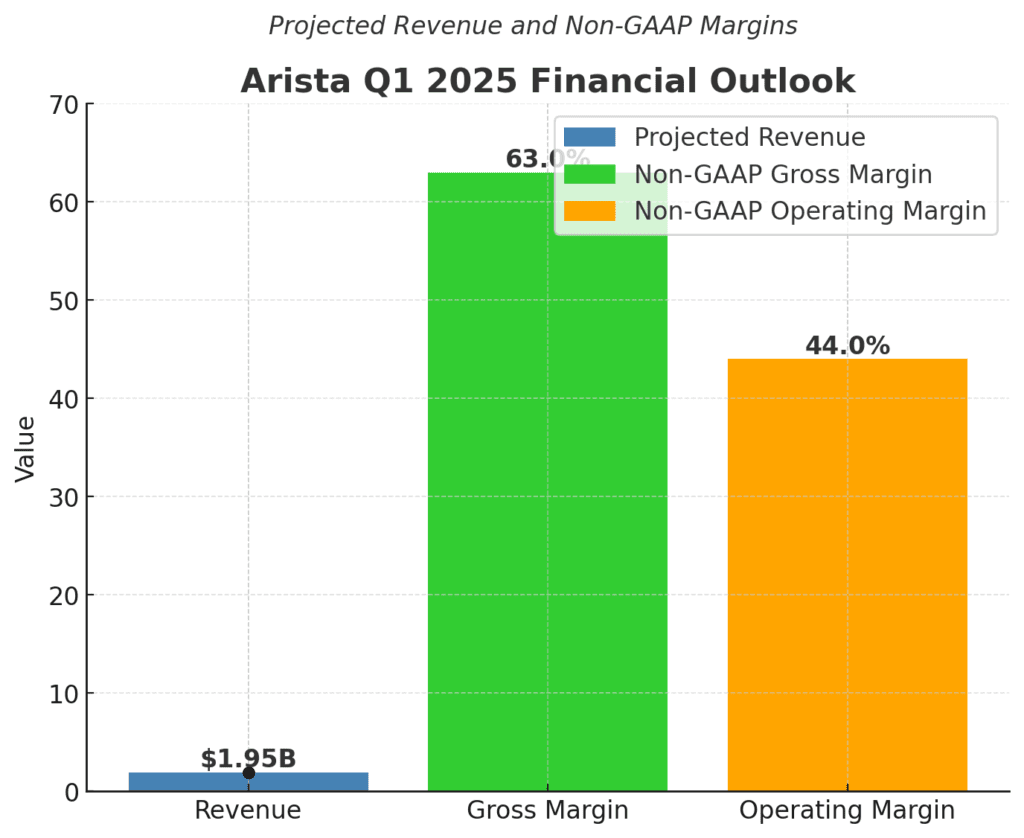

Arista’s financial outlook for the first quarter of 2025 reinforces this optimism. The company projects revenue between $1.93 billion and $1.97 billion, with a non-GAAP gross margin of approximately 63% and a non-GAAP operating margin of around 44%. These targets suggest a steady hand on the tiller, balancing aggressive investment in AI and campus markets with a commitment to profitability.

“We continued to innovate for our customers with best-of-breed platforms enabling AI for networking and networking for AI,” said Jayshree Ullal, Arista’s Chairperson and CEO. Her words encapsulate the dual role Arista plays: a pioneer in AI infrastructure and a stalwart in traditional networking. As 2025 unfolds, all eyes will be on whether Arista can maintain this delicate equilibrium.

What Arista’s Success Means for the Industry

A Blueprint for Resilience

Arista’s 2024 performance offers a masterclass in navigating uncertainty. While supply chain bottlenecks and economic headwinds have stymied many tech firms, Arista has thrived, leveraging its strong balance sheet and robust cash position to double down on innovation. This resilience is a lesson for data center operators and tech leaders: adaptability, paired with a clear strategic vision, can turn challenges into opportunities.

The AI Imperative

The company’s AI focus also underscores a broader industry truth: artificial intelligence is no longer a niche experiment but a foundational force reshaping data centers. As enterprises race to deploy AI at scale, the demand for high-performance, low-latency networks will only intensify. Arista’s Etherlink platforms and partnerships with Meta and NVIDIA position it as a frontrunner in this race, setting a benchmark for competitors like Cisco and Juniper Networks.

The Human Element

Finally, Arista’s story is one of human ingenuity. From its collaboration with Arizona State University to train Afghan refugee students in technical skills to its Alabama Fiber Network initiative, the company demonstrates that technology’s ultimate value lies in its ability to empower people. This ethos—blending profit with purpose—may well be its most enduring legacy.

Conclusion: A Networked Future Awaits

Arista Networks’ 2024 was not just a year of financial triumph; it was a declaration of intent. By marrying cutting-edge AI solutions with a steadfast commitment to data center and campus networking, Arista has carved out a unique space in a crowded market. Its $7 billion revenue milestone is impressive, but the real story lies in what comes next: a world where AI and networking converge to unlock unprecedented possibilities.

For data center professionals, Arista’s journey offers both inspiration and a challenge. How will your organization adapt to the AI-driven future? What investments will you make to stay ahead of the curve? As Arista charts the course, the answers to these questions will define the winners of tomorrow’s tech landscape.

Further Reading:

- Arista Networks’ Q4 and Year-End 2024 Financial Results Press Release

- Meta’s AI Infrastructure Initiatives

- NVIDIA’s GPU and AI Solutions

- Arizona State University Refugee Program

Frequently Asked Questions (FAQ)

Q: What drove Arista Networks’ revenue growth in 2024?

A: Arista’s revenue surged to $7 billion in 2024, a 19.5% increase from 2023, fueled by strong demand for its data center switching solutions, AI networking platforms like Etherlink, and expansion into campus and routing markets. Partnerships with Meta and NVIDIA also bolstered its AI-driven offerings.

Q: How does Arista’s Etherlink AI platform differ from traditional networking solutions?

A: Unlike multi-tier networks, Etherlink uses efficient one- and two-tier topologies, optimizing performance and reducing latency for AI clusters. This design supports thousands to hundreds of thousands of XPUs, making it ideal for large-scale AI workloads.

Q: What is the significance of Arista’s partnership with Meta?

A: Meta’s deployment of Arista’s 7700R4 Distributed Etherlink Switch in its Ethernet-based AI cluster validates Arista’s technology for hyperscale AI applications, potentially setting an industry standard for AI infrastructure.

Q: How does Arista’s Wi-Fi 7 technology benefit enterprises?

A: The C-460 Wi-Fi 7 access points address bandwidth-intensive needs like AR/VR, IoT, and video streaming in high-density settings, offering enterprises a future-proof solution for campus and corporate networks.

Q: What are Arista’s financial projections for Q1 2025?

A: Arista expects revenue between $1.93 billion and $1.97 billion, with a non-GAAP gross margin of about 63% and a non-GAAP operating margin of approximately 44%, signaling continued growth and profitability.

Q: How does Arista contribute to societal goals beyond profit?

A: Initiatives like the Alabama Fiber Network project, which expands internet access in rural areas, and its partnership with Arizona State University to train refugee students, highlight Arista’s commitment to bridging the digital divide and fostering education.